What Are Assets

Assets are the economic resources that are controlled by an individual, by a company, or by a corporation in the expectation of future economic benefit to the business. Or in simple words any economic resource controlled by the entity as result of past event.

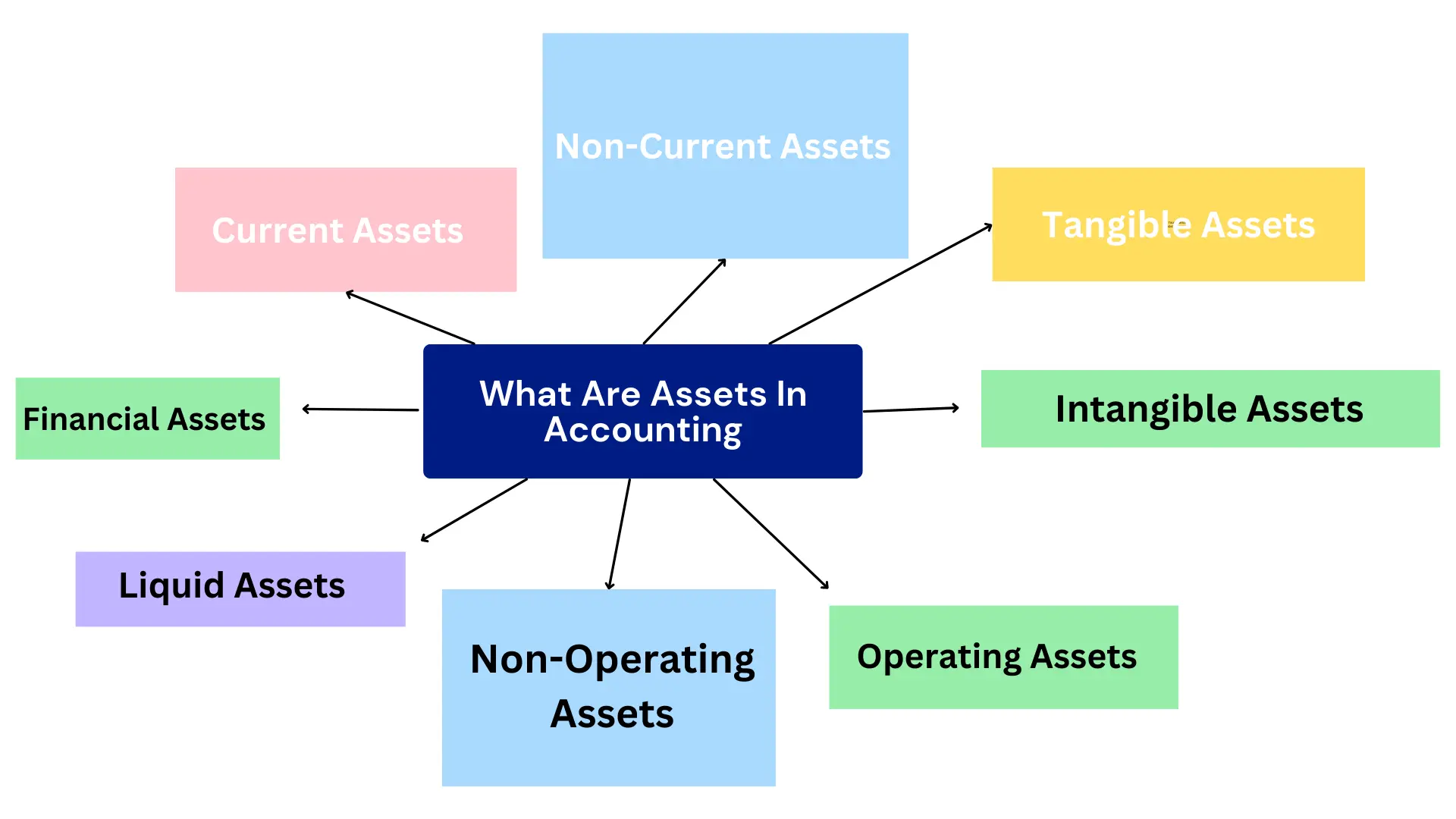

What Are Assets In Accounting

There are dozens of asset definitions in accounting some of the most popular definitions are the following:

- The economic resources that have some value and can bring some benefit to the owner

- Anything that can be used legally without getting anyone’s permission (means have legal ownership)

Definition Of An Asset By IFRS

International Financial Reporting Standard is a widely used Financial Reporting System across the world.

IFRS definition of an asset: a present economic resource that is controlled by an entity as a result of past events and can produce future economic benefit.

Definition Of An Asset By GAAP

General Accepted Accounting Principles that are used across the United States of America. This standard defines an asset as “ a resource that has economic value and is owned or controlled by an entity with the vision of future economic benefit.

Characteristics Of An Asset

- Present Right or Ownership

- Has economic Value and Economic Benefits

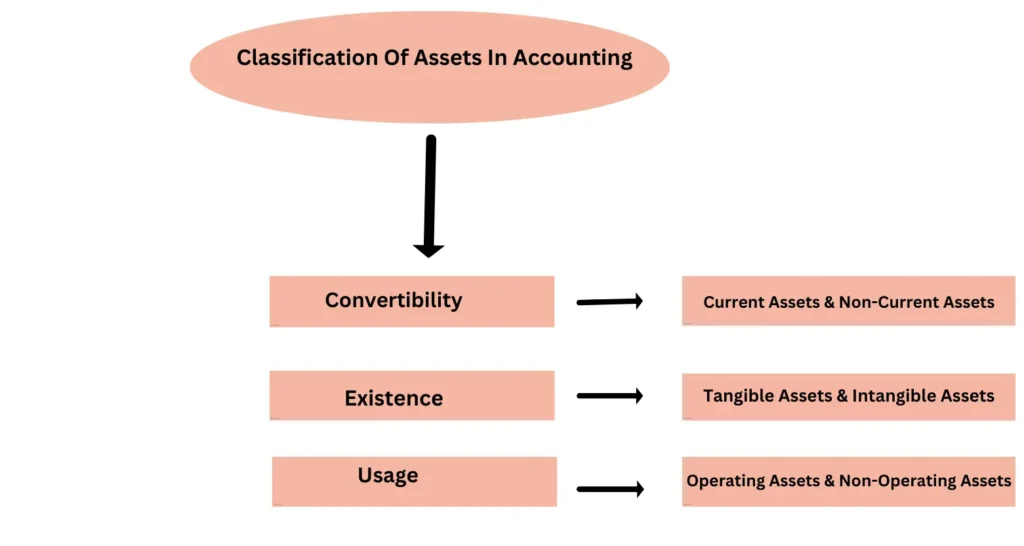

Classification Of Assets In Accounting

Following are the three classifications of assets that are used in accounting to classify an asset.

Convertibility

The term convertibility is defined as how an asset is easy to convert into cash and how much time it will take. Following are the two assets that are classified as convertible assets.

Current Assets: These assets are classified as short-term assets used within a year and can easily be converted into cash. (Examples: Business inventories, receivables, cash, other liquid assets, and financial assets).

Non-Current Assets: These are long-term assets and cannot be converted into cash easily and normally lose their value over time because they are depreciated over their life. (E.g. Vehicles, buildings, and PPE).

Existence

The term existence is used to classify assets on the basis of their shapes or physical existence. Following are the two assets that are classified on the basis of physical existence.

Tangible Assets: Those assets that have physical existence and can be seen or touched are termed tangible assets. (E.g. machinery, building, stock, etc.).

Intangible Assets: Those assets that have no physical existence or assets cannot be touched or seen. (E.g. Goodwill, Patents, and Brands).

Usage

Assets that are classified on the basis of uses and purposes within a business are classified in this class. The following are the two assets that are classified in this class.

Operating Assets: Those assets that are used in the business’s ongoing operations and are needed for making products and sales such as cash, inventories, receivable and payable.

Non-Operating Assets: Those assets that are part of a business but normally not used in the business’s ongoing operations such as spare or extra equipment, idle cash, or sometimes investable assets. Non-operating assets increase the value of non-operating income on the balance sheet.

What Is The Difference Between Current Asset And Non-Current Asset

| Current Assets | Non-Current Assets |

| Can convert Into Cash Within 1 year | Takes more time to convert into cash than the Current asset |

| It is a short-term asset | It is a long-term asset |

| Reported on lower market value | Reported on historical cost |

| Contribute in sales | Contribute in production |

| Need continuous intention to work efficiently | Need good strategic planning to work efficiently |

What Is The Difference Between Tangible Assets And Intangible Assets

| Tangible Assets | Intangible Assets |

| Have physical shape or existence | Have no physical shape but have values |

| They are depreciated | They are amortized |

| It has a finite useful life | Can be finite infinite |

| They are reported on market value | They are estimated |

| Can easily be sold or bought directly in the market | Limited or sometimes tough to buy or sell |

What Is The Difference Between Operating Assets And Non-Operating Assets

| Operating Assets | Non-Operating Assets |

| Directly used in business operations | These are not the core part of the business |

| Contribute in revenue | Contribute only to non-operating income |

| Directly impact profit | Have no direct impact on the profit of the business |

| They are valued as per the contribution | They are valued at market price or fair value |

| They are related to operational risks | While these assets are not |

What Are Fictitious Assets

These are artificial assets that have no physical existence or monetary value. When there are some expenditures or losses that occur in the business that cannot be classified in any accounts such as expense or intangible assets then these entries are made to write off that cost straight away.

Some examples of fictitious assets:

- Legal fees of incorporation setup

- Registration cost of a business

- Promotional expenses are also a kind of fictitious asset

- Shares that are issued at a lower price than face value

- Research and development expenses are also considered fictitious assets, etc.

What Are Total Assets In Accounting

Total assets mean the total value of the assets that are owned by an individual, company, or business. The total assets are recorded in the financial position statement and consist of both tangible and intangible assets.

How to calculate total assets

Total assets = Total value of the current assets + non-current assets

What Are Average Total Assets In Accounting

The average total assets mean the average value of the company’s assets over a specific period (normally a year). The average total assets method is very useful to determine the efficiency and profitability of a company as per the revenue throughout the year.

How to calculate average total assets

For calculating the total average assets just add the value of the total assets at the end and the value of the total assets at the start of the financial year and divide it by 2.

What Are Net Assets In Accounting

The net assets are referred to as the remaining amount of the assets after subtracting all the liabilities from the business balance sheet.

How to calculate net assets

To know the value of the net assets, subtract the total liabilities from the total assets.

Net asset formula = Total assets (Current and Non-Current Assets) − Total Liabilities (Current and Non-Current Liabilities)

How Assets Are Considered

Anything that is owned by an individual, company, or corporation that can give benefit in the present time or in the future, or is expected to give some benefit in the long run is considered an asset.

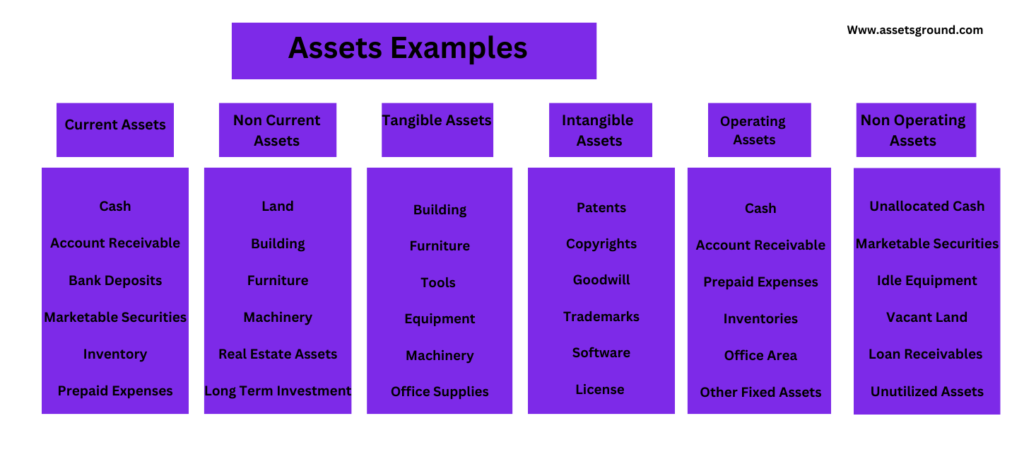

What Are The Examples Of Assets

The assets can be in infinite shapes but some of the most used assets in accounting are the following:

- Cash

- Inventories

- Account Receivable

- Prepaid Expense

- Short term Investment

- Advance To Supplier

- Marketable Securities

- Accrued Income

- Bank Deposit

- Land

- Building

- Machinery

- Vehicles

- Patent

- Trademark

- Copyright

- Goodwill

- Subsidiary

- Associates

- Future Tax Benefits

- Furniture

- Fixture

- Office Equipment

- Equity Investment

- Bonds

- Debentures

- Pension

- Royalty

- Long term contract

- Leasehold Improvement

- Trade Secrets

- License and permits

- Interest Income

- House

- Business Software, etc.

Assets FAQS

Is money an asset?

Yes, if money is in the form of cash or cash equivalents then it is considered as a current asset.

Is interest revenue an asset?

Interest revenue for the year means interest receivable is treated as a current asset in the balance sheet of a company.

Are sales an asset?

Sales are not assets nor it is a liability, these are income or revenue which are recorded in the statement of profit and loss.

Is additional paid-in capital an asset?

Additional paid-in capital is not really an asset but it can be utilized and invested which indirectly increases the value of assets. APIC is recorded under the heading of assets.

What are noncash assets in accounting?

Noncash assets are those assets that are not in the form of cash or cash equivalents but have some value in the business. Some of the most popular non-cash assets are Investments and prepaid or deferred expenses.

What is the meaning of monetary asset?

Monetary assets are those assets that are easily convertible into cash and have a very low risk of reducing value. Some of the best examples of monetary assets are cash, bank deposits, and short-term investments.

Is treasury stock an asset?

Treasury stock is not treated as an asset in the balance sheet and is subtracted from the shareholder’s equity. Treasury stock is something that does not represent ownership in the company.

Is rent expense an asset?

Rent expense is not an asset but it is treated as operating expense in the statement of profit and loss. But the prepaid expense is an asset.

Is notes receivable an asset?

The note receivable is an asset and can be recorded under the heading of the current or non-current asset according to the repayment duration. The note receivable is the amount that the borrower pays within the specified date of an agreement.

What is the difference between liquid and illiquid assets?

The main difference between liquid and illiquid assets is, that liquid assets are easy to convert into cash and have a good market while illiquid assets have a limited market and cannot be converted into cash in a short time.

Is a retirement account an asset?

Retirement accounts are treated as an asset (Non-current asset) because they are healed for a long period under the financial institutions, it can be in the form of bonds, stocks, and other investments.

Which of the following is not considered as an asset?

- Cash

- Research and development expense

- Car

Research expense is always treated as an expense but development expense can be capitalized as an asset if certain conditions are met.

Which of the following is classified as a plant asset?

- Building

- Land

- Machinery

- Car

All of the above options are classified as plant assets because all these assets are non-current assets.

Which of the following is not an asset?

- Car

- Office Supplies

- Bank Overdraft

- Machine

A bank overdraft is a liability, not an asset.

Is furniture an asset?

Yes, furniture is an asset and is recorded in the section of non-current assets.

Is office supplies an asset?

Yes, office supplies are assets and are recorded in the section of non-current assets.

Are fees earned an asset?

Until fees earned are received they are recorded in account receivable which is an asset account but once the amount is received it is subtracted from the account receivable and recorded in the cash book.

Is a bank account an asset?

Yes, the bank account is an asset and is recorded in the section of current assets.

Is building an asset?

The building is an asset and is recorded in the section of non-current assets as this falls in the category of PPE (Property Plant and Equipment).

Is mortgage an asset?

A mortgage can be an asset because one can use it without any permission once the amount is received but after a certain time, the amount has to be paid with the interest that falls in the category of liability.

Is cash considered an asset?

Cash is an asset and is recorded under the heading of current assets.

What is an asset class?

Asset class refers to the group of assets that has similar characteristics and laws.

Is an asset a debit or credit?

Whenever assets value increases its balance is recorded as debit and when assets are decreasing it becomes credit.

Is home equity an asset?

Home equity is the net worth of an individual and it is classified as an asset.