Is A Patent A Current Asset Or A Non-Current Asset?

A patent is an intellectual property that gives legal ownership to the inventor to restrict others from creating, using, and selling the invention

A patent is an intellectual property that gives legal ownership to the inventor to restrict others from creating, using, and selling the invention

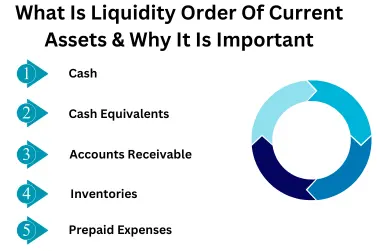

Liquidity of current assets refers to the sequential process by which a business converts its current assets into cash.

Interest receivable is the amount that a company has earned but has yet not been paid in cash or other economic resources.

Allowance for doubtful accounts is the contra asset that reduces the amount of the receivables, so it is not treated as

The building is recorded under the Property, Plant, and Equipment which are the fixed assets and losses their value over their useful lives

Property, plant, and equipment are widely used in manufacturing businesses for manufacturing goods. These assets are the core part of the business operations

Goodwill is one of the most elements of the company’s balance sheet but it is not a current asset because goodwill is not expected to sale or converted

Common stocks are the initial investments of the shareholders when they first buy the shares of the company. The common stocks do not come with fixed value

These investments can be exchanged with cash or other economic resources that can be used in the business’s ongoing operations

Once the assets are classified as assets held for sale then these assets are not used in the business’s ongoing operations and their net value is expected to recover

It is crucial for marketable security to be treated as a current asset in the balance sheet to meet some requirements such as for bond maturity must be less than one year or

Accumulated depreciation is not treated as a current asset in accounting because it shows the expense which is deducted from the asset’s original value

End of content

End of content