What Is Asset Allocation? Classes, Types, And Importance

Allocation is the process of sharing resources, especially money or other economic resources for some purposes such as minimizing the risk or getting investment opportunities.

What Is Asset Allocation

Asset allocation is a business tactic used to make a secure investment portfolio. Assets allocation is an investment strategy that helps investors to separate or divide different asset classes because every asset is associated with different risk and return levels.

Risk cannot be removed but it can be mitigated by asset allocation as it helps investors to diversify risk across the other assets that minimize the overall risk of the portfolio and rises the return as well.

Asset allocation is an investment strategy that varies according to the risk tolerance, time horizon, and objectives of an individual, company, or corporation.

What Are The Three Main Asset Classes For Assets Allocation

The followings are the three major classes that are widely used for asset allocation.

Equities: equities and stocks are the symbol of ownership in the company. The stocks play an essential role in a company’s statements for a long period as they provide high returns but high risk as well.

Fixed Income: bond is a common example that provides a stable return but it is lower than stocks but it is also associated with low risk than stock.

Cash & Cash Equivalents: These assets are associated with very low risk but they also offer low returns. Cash, treasury bills, money market funds, and certificates of deposits are common examples of cash & cash equivalents.

Major Types Of Asset Allocation

There are different types of asset allocation that investors used for their investments portfolio. The followings are the 2 major types of asset allocation.

Strategic Asset Allocation

One of the most popular and widely used tactics in asset allocation is strategic asset allocation which is used for the long term based on an investor’s financial objectives, risk tolerance, and time horizon.

In strategic asset allocation, investors rebalanced their investment portfolios repeatedly to continue with the desired asset allocation profile. The main purpose of strategic asset allocation is the maintain the risk and return in the long run.

Tactical Asset Allocation

Tactical asset allocation is typically used for managing the short-term investment portfolio because of market or economic conditions or for other investment opportunities.

This approach requires more efficiency and activeness and it may cost high to manage the investment portfolio properly.

Why Asset Allocation Is Important

Asset allocation is one of the most widely used and successful investment tactics that bring stability and profitability to an investment portfolio of an investor. The followings are the major reasons why asset allocation is important.

- Asset allocation is a very helpful component for managing risk by diversifying the assets into different classes

- The process plays a crucial role in achieving financial goals and objectives

- Asset allocation helps investors to focus more clearly on long-term projects

- Asset allocation helps investors to be stable in the market during the instability of the market

- This plays an essential role in adjusting the risk and getting more returns using effective investments tactics

- Asset allocation helps investors to maintain purchasing power during the inflation

There are some benefits of using the asset allocation technique in a business as it helps to customize the investment portfolio, enhanced return, minimize risk, provide flexibility, and reduce the cost of transactions when exchanging.

FAQs

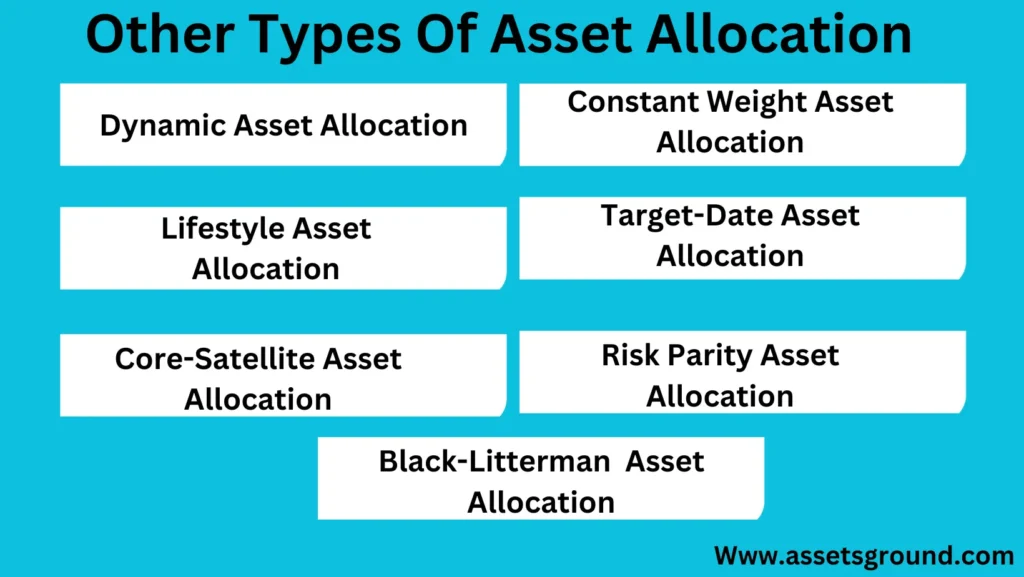

What is the black Litterman model in asset allocation?

Black Litterman is an asset allocation model widely used in modern portfolio theory (MPT). This model uses market views and past data to make an optimal investment portfolio. The model was introduced by Fischer Black & Robert Litterman in 1990.

What is the core satellite asset allocation model means?

The core-satellite asset allocation model is the combination of two portfolios, the core portfolio is a large part of the investment which consists of index-based investments such as ETFs and low-cost index funds while the satellite portfolio is surrounded by the core portfolio and is managed actively such as individual stocks or actively managed mutual funds.

What is the target date asset allocation model?

The target assets allocation is an investment portfolio strategy that is designed to mitigate the risk when the target date approaches. The most common example of a target date model is saving accounts.

What is the lifestyle asset allocation model?

The lifestyle model is designed and works as per the investor’s life stages and risk capacity. Investors can make their investment portfolios according to their needs or changing conditions over time. The model is based on the investor’s age, risk strength, and investment goals.

What is the constant weight asset allocation model?

In this allocation model, investors maintain a constant or fixed balance to the different asset classes and rebalance it annually until the dynamic model is used.

What is the risk parity asset allocation model?

The risk parity asset allocation model is designed to make the investment portfolio based on the risk rather than the other traditional methods. In this model, investors check the risk level to allocate the funds to different components in the investment portfolio.

What assets can be included in the asset allocation?

Assets that can be included in the asset allocation are stocks, bonds, cash, options, gold, real estate investment, cryptocurrencies, etc.

What is the best asset allocation percentage?

The asset allocation strategy is different for every investor as per their tolerance, time, and objectives. The following is the best asset allocation percentage according to most investors:

- 60% for Equities (Stocks)

- 30% for Fixed Income (Bonds)

- 10% for Cash & Cash Equivalents

What are the three factors that affect asset allocation?

Time, risk tolerance, and objectives are the three factors that affect the investment portfolio.

What is the objective of asset allocation?

The main objective of asset allocation is to balance the risk and return in the investment portfolio.

How do you balance asset allocation?

Asset allocation can be balanced by selling or buying one or more assets or adding additional funds to the portfolio.