Is Notes Receivable A Current Asset? How It Is Treated In Accounting

Notes receivables are the written promises that state the date when the amount will be paid to the creditors (Companies who sell goods on credit) by the debtor (Customers who purchase goods on credit).

Is Notes Receivable A Current Asset

Notes receivable is the written document that the customers make to agree to pay a specific amount on a specific date. The customer can be an individual, other party, business, or financial institution.

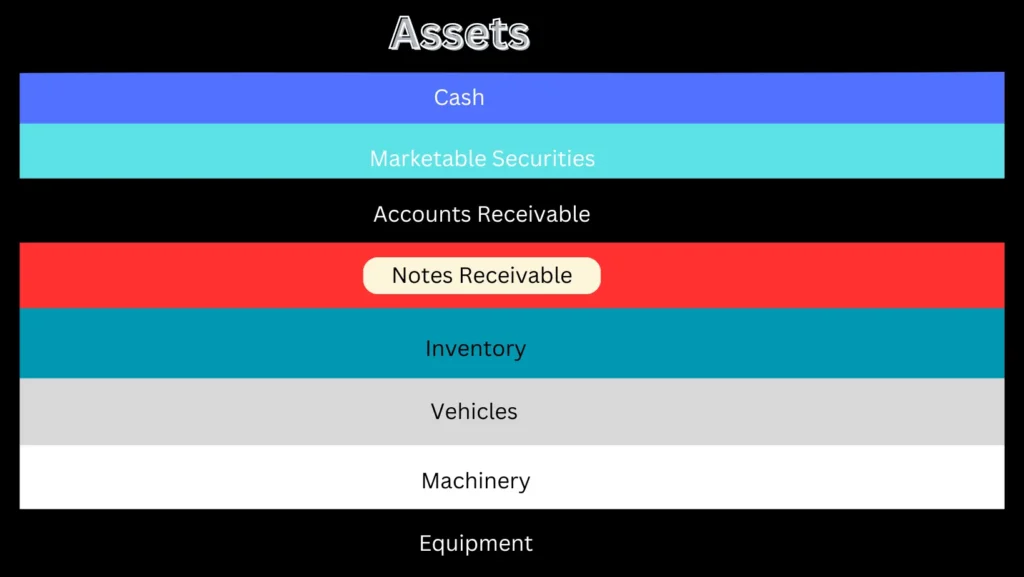

Notes receivable can be treated as either current assets or non-current assets depending on the timelines and intention of the company.

Notes receivable are treated as current assets when a company is expected to receive the amount within a short period typically one year or an operating cycle. Still, if the amount is not expected to receive within a year or an operating cycle then it is treated as non-current assets in the balance sheet.

It is vital to classify the notes receivable in the financial statements according to their terms and timelines to provide accurate information about the financial position and liquidity of the company.

FAQs

What is the payee and maker in the notes receivable terms?

The payee is the creditor who will receive the money while the maker is the debtor who will send the money to the payee according to terms of the note.

Which one is better a note receivable or a simple credit transaction and why?

Note receivable is the better option because there is a very high chance of getting payment on time with the note receivable as compared to the simple credit transaction. Note receivable can be used as evidence in legal proceedings and includes some interest rate that works as an investment.

When a note receivable is treated as a current asset in the balance sheet?

When a company is expected to get the amount within a year or an operating cycle, it is treated as a current asset.

When a note receivable is treated as a non-current asset in the balance sheet?

When a company does not expect to get the amount within a year or an operating cycle, it is treated as a non-current asset.

What is the initial double entry for note receivable?

For exchange of goods or services, debit note receivable and credit account receivable.

How to record interest on notes receivable?

As interest on receivable is our income, it is recorded as (Debit interest receivable because we have not yet received the amount and credit interest revenue.

How note receivables is treated in the statement of financial position?

If the notes receivable’s maturity date is less than one year then it is treated as a current asset and if the maturity date is more than a year then it is recorded as a non-current asset in the balance sheet.

How to write off notes receivable from the balance sheet?

Once get the amount, debit cash and credit note receivable account from the final account.

What is the normal maturity date of a note receivable?

Notes receivable maturity date depends on various factors such as company size, and the nature of goods or services supplied. But normally it is seen between 30 to 90 days after the invoice is issued.