Are Held For Sale Assets Current Assets? & How They Should Be Valued At In The Balance Sheet

Held-for-sale assets are those assets that the company wants to sell. There can be many reasons for selling assets such as the company does not need that asset anymore or the asset is not performing well.

Are Held For Sale Assets Current Assets?

Yes, these assets are shown in the balance sheet as current assets because they are expected to be sold within a short period typically one year or less.

Once the assets are classified as assets held for sale, they are not used in the business’s ongoing operations. Their net value is expected to recover by selling rather than using it in the business.

Assets of different natures can be included in assets held for sales such as property, plant, equipment, investments, or other long-term assets. Once the assets are classified as held for sale they are again reclassified as current assets and shown separately in the balance sheet as assets held for sale to show the company’s intent for selling.

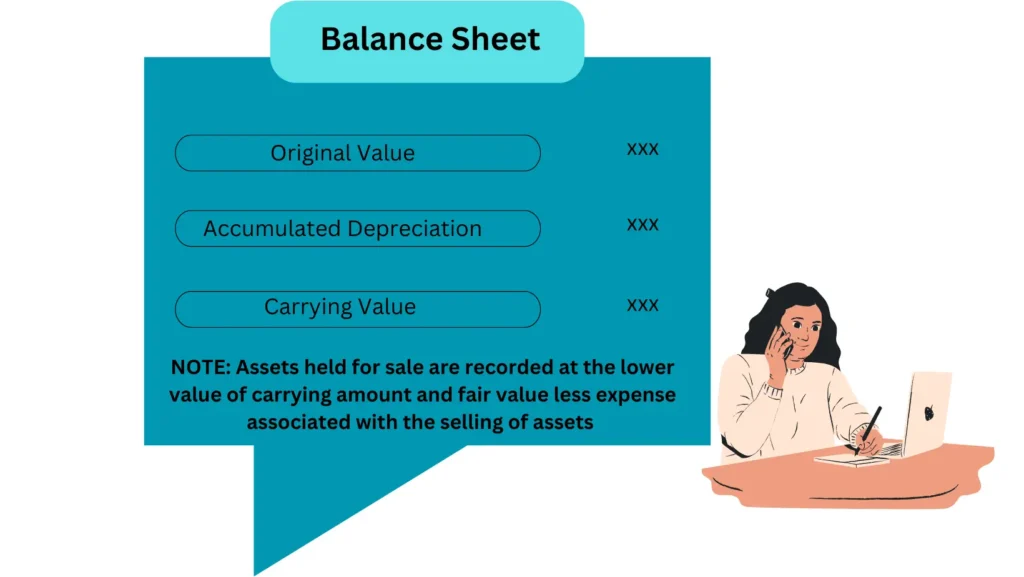

Assets held for sale are always recorded at lower than their fair value less any cost associated with the sale of that assets. It is essential to record the impairment of assets that occurred due to the reclassification of assets in the income statement instantly.

Criteria For Assets Held For Sale

The following are the criteria for assets to be recorded as assets held for sale in the balance sheet:

- Management plans to sell the asset

- Management is actively looking for a buyer

- The asset must be available for sale in the current condition

- The sale is possible and will be closed within a year

- The price of selling assets should be relevant to the current fair value

- Unlikely to change the plan of selling assets

Example Of Asset Held For Sale

XYZ purchased an asset worth $50,000 and till now the accumulated depreciation is $10,000. The company is expected to sell the asset at $40,000 if the company spends $3,000 on selling.

The carrying value of the asset is ($50,000 – $10,000)= $40,000

The fair value of the asset is ($40,000 – $3,000)= $37,000

$37,000 will be recorded as an asset held for sale because it is less than the carrying value of the asset which is $40,000 in this question.

FAQs

Why are held-for-sale assets recorded as current assets in the balance sheet?

Because these assets are expected to be sold within a year, they are treated as current assets.

What is the treatment of assets held for sale according to the accounting standards?

According to the IFRS and GAAP, assets held for sale must be recorded at a lower value than their fair value less any expense associated with the selling of assets.

What happens when an asset is held for sale?

The asset will not be used in the business’s ongoing operations, the depreciation will not be charged anymore, and the asset will be reclassified as a current asset in the balance sheet.

What is the most common example of an asset held for sale in a business?

Inventory is the most common example of an asset held for sale in the normal course of a business.