What Is Dynamic Asset Allocation? Importance And Its Example

What Is Dynamic Asset Allocation

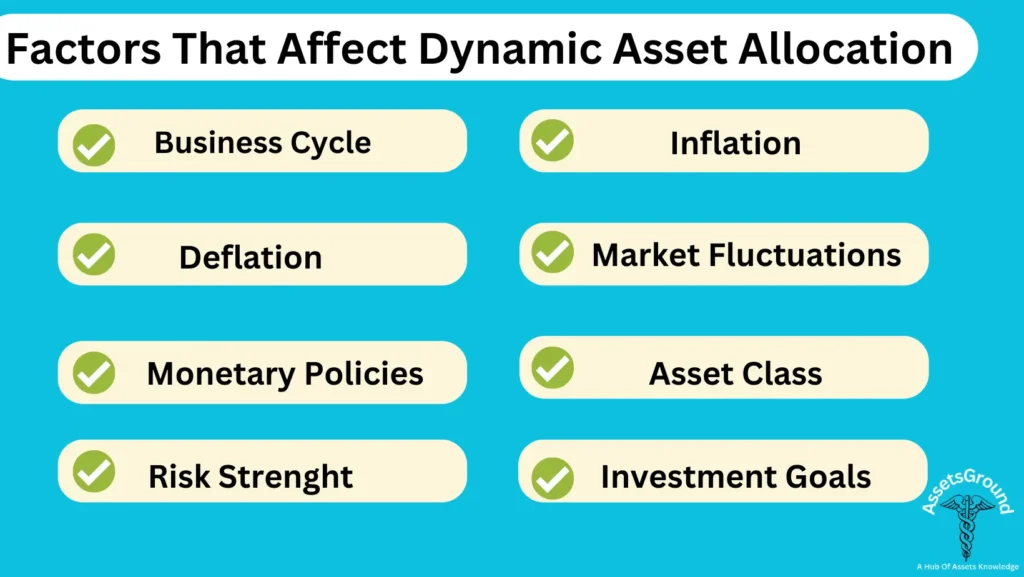

Dynamic means force that changes constantly and asset allocation is the sharing of assets in different classes. It is a strategy of an investment portfolio that changes frequently according to market fluctuation.

DAA is commonly used when an asset performs badly or well. The strategy involves in reducing the fund of those assets that perform worst and increasing the amount to those assets that perform well.

The most important goal of DAA is to increase the portfolio returns while controlling the risk as per the market behavior or fluctuation and economic indicators.

DAA is different from the traditional allocation where a fixed allocation is set to the different asset classes and rebalances the allocation over time.

Why Dynamic Asset Allocation Is Important

- Flexibility is the most important part of DAA as it allows investors to manage their investment portfolio flexibly and the portion of different asset classes according to their performance

- Active Management is very important for DAA to become the best choice as it helps investors to monitor the current market behavior. Based on market behavior and economic indicators investors can make better decisions

- Risk Management tactics can be used easily through the allocations to those assets that perform well from those that perform worst

Example Of DAA

An entity is using DAA and enters the bear market. The investment manager will choose to reduce the equities investment and increase the fixed-income investment. This is because, during the bear market, almost every stock price is declined.

If the stock in the portfolio is heavy it will be sold out to invest in the fixed-income elements such as treasury bills, bonds, and certificates of deposits. Once the bear market change to bullish, the investors will move vice versa.

Advantages And Disadvantages Of Using DAA

| Advantages | Disadvantages |

|---|---|

| Performance and returns of different asset classes can be maximized through allocation to those assets that perform well | DAA is adjusted with the market behavior so it cost high as compared to other strategies |

| The diversified portfolio helps investors to manage the risk and increase the returns | Active management is sometimes not possible that results in a loss |

| The market trend will be helpful to increase the returns if the portfolio manage effectively | Frequent adjustments can change the emotions of investors such as fear or greed |