Is Life Insurance An Asset

Life insurance is a contract between the insured and the insurance company that provides financial protection in the event of emergency needs or other circumstances. Life insurance is very needful for a person but all types of insurance are not considered or give benefits as assets.

Is Life Insurance An Asset

An insurance policy that provides cash value components can be considered an asset but a life insurance policy that does not allow cash value component is not an asset. The following are the major types of insurance. Read ahead to know what types of life insurance are assets.

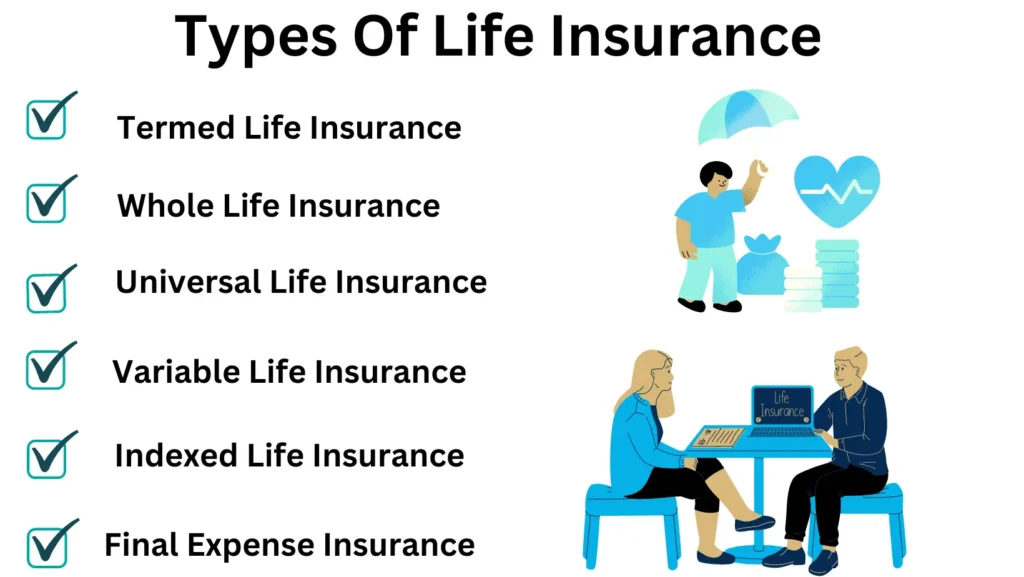

Is Termed Life Insurance An Asset

Termed insurance provides coverage for a specific time normally 10 to 30 years. If the insured person passes away then the beneficiaries receive the amount. This type of insurance policy is not considered an asset because you cannot use your insurance amount when you are alive.

Is Whole Life Insurance An Asset

It is a type of permanent life insurance that provides financial coverage for the whole life of an insured till premiums are paid. This type of life insurance is generally considered as an asset because it carries the cash value and can be converted into cash easily even after limitations.

Characteristics Of Whole Life Insurance:

- The cash value accumulates over time

- Can be converted into cash but have some limitations

- Returns are normally lower

- Protect financially and provide risk management. etc.

Is Universal Life Insurance An Asset

It is a kind of permanent life insurance that involves both death benefits and cash value elements. The policy accumulates the cash value over time on premiums and can be invested to get the interest. This insurance can be an asset and can be used for various purposes. Make sure to check the terms and conditions before getting life insurance.

Is Variable Life Insurance An Asset

Another permanent life insurance can be an asset because it combines both death benefits and investment components. One part or portion is used for covering the insurance policy and the remaining balance can be invested in stock, bonds, and other investments.

Is Indexed Life Insurance An Asset

It is an insurance policy that has death benefits and cash value components as well that accumulates with time. The cash value component can be invested in the market to get the profit on the bases of the market index. The major reason for this policy is to cover life insurance instead of doing investments.

Is Final Expense Insurance An Asset

Final expense insurance also termed funeral or burial expense is designed to cover the expense that will occur when an insured passes away. The amount will be used for funeral and financial obligations that were due to the insured person. The final expense insurance is generally not considered as an asset and it is paid after the death of an insured.

Life Insurance FAQs

Is life insurance an asset or not?

Life insurance can be an asset or not because it depends on the policy type and terms & conditions. The most common type of life insurance that is considered an asset is whole life insurance because it has death benefits and cash value elements as well.

Is life insurance considered a liability?

Life insurance that does not generate value for you can be a form of liability because you have to pay the annual premium but you cannot get the money until you are alive. The most common life insurance that falls in this category is termed life insurance.

Is life insurance a liquid asset?

Life insurance can be a liquid asset if it offers cash value such as whole life insurance but they have some limitations as well.