Is Utilities Bill Expense An Asset Or A Liability?

Utilities are the services provided by third parties such as the government, agencies, or private companies. Utilities such as gas, water, and electricity are essential for daily life and business operations.

Is Utilities Bill Expense An Asset Or A Liability?

Utilities are very necessary for making business operations smooth. In large manufacturing businesses machines are commonly used in producing products, so those machines use electricity or other resources to work properly and that costs a business.

Utilities expense is an expense account and it is recorded in the statement of profit and loss as an operating expense. Generally, it is recorded as an expense in the financial statements but there are some conditions when utilities are treated differently. Let’s discuss when utility expenses are treated differently in accounting records.

When utility expenses are treated as an asset in the balance sheet?

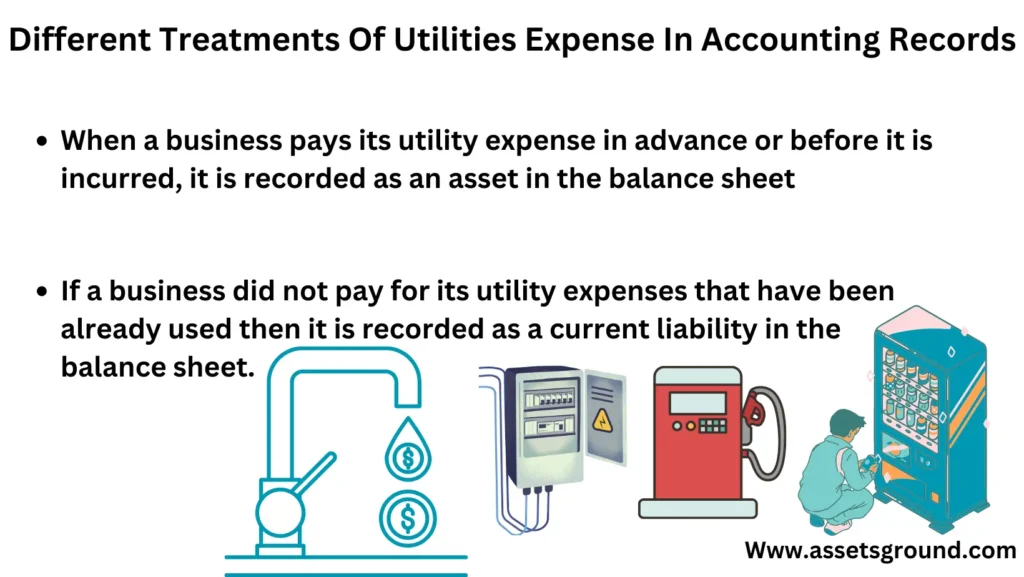

When a business pays its utility expense in advance or before it is incurred, it is recorded as an asset under the heading of current assets in the statement of financial position.

When utility expenses are treated as a liability?

If a business uses accrual bases accounting, it records expense when it is incurred. If a business did not pay for its utility expenses that have been already used then it is recorded as a current liability in the balance sheet. And once it pays it becomes an expense that is moved from the balance sheet to the income statement.

FAQs

Is utilities expense an asset or equity?

Utilities expense is an expense account but it can be an asset if it is paid in advance. Utility expense can impact equity because the expense account reduces the profit which is added to the equity section after deducting all the taxes and dividends.

What type of account is utility expense?

It is an expense account and is recorded in the income statement.

What is the double entry for utility expense when paid in cash?

If a business pays utilities using cash,

- Debit utilities expense account

- Credit Cash

What is the double entry for utility expense when it is not paid?

When a business did not pay its expense on time it becomes a liability, the double entry will be:

- Debit utilities expense account

- Credit account payable

And when it is paid:

- Debit account payable

- Credit cash/bank

Where do utilities go on the balance sheet?

Utilities can be recorded on the balance sheet if it is paid in advance (Prepaid Asset) or if it is not paid when incurred (Accrued Expense). When the utilities are paid it is recorded in the income statement as an operating expense.