What Is Liquidity Order Of Current Assets & Why It Is Important

Liquidity is the process of how quickly one can get cash whenever needed. Liquidity occurs when an unforeseen condition arises or a business is going to close.

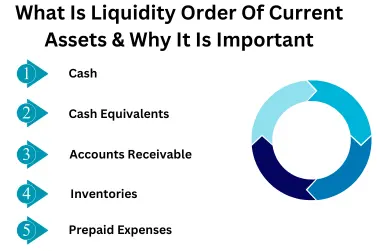

Liquidity Order Of Current Assets

Liquidity order of current assets refers to the sequential process by which a business converts its current assets into cash.

Those current assets that are highly liquidated are recorded at the top while those assets that take more time to convert into cash are recorded at the bottom.

Liquidity measures how quickly assets are converted into cash without losing their value or affecting their market value. The normal order of liquidity of current assets is as follows:

1: Cash

Cash is the most liquid asset as it is readily available economic resource that can be used at any time as it is received and it always comes on the top of liquidity order.

2: Cash Equivalents

These assets are recorded on the 2nd in the list of most liquid assets as these are exchangeable on daily bases without losing their value. Money market account and marketable securities are the best examples of cash equivalents.

These accounts are the outstanding balance in the balance sheet of a company that has yet not been paid by the customers in exchange of goods or services on credit. Even these accounts are not easily converted into cash but these are expected to received within a year.

4: Inventory

Inventories are the goods and products that a business makes and sale in daily business operations. It takes little more time as compared to the cash & cash equivalents, and accounts receivables.

5: Prepaid Expenses

Those expenses that are already paid but yet not used are said to be prepaid expenses. These are not possible to convert into cash directly but these shows the future cash savings and are recorded as current assets in the balance sheet.

Why Liquidity Order Of Current Assets Is Important?

Liquidity order is essential when an unforeseen conditions are occured. The followings are the major reasons why liquidity order is Important.

- Liquidity order plays an essential role in paying short-term obligations

- It helps to manage the working capital effectively

- Liquidity order is very helpful when a business needs finance

- It helps a business to evaluate its financial ability, so management can make investment decisions

- A well-structured liquidity order attracts more lenders and investors

- It helps a business to manage its cashflow

- It helps a business to identify liquidity risk, etc.