What Is Strategic Asset Allocation? Example & Benefits

What Is Strategic Asset Allocation

It is a long-term investment portfolio strategy that investors use for managing and maintaining the balance annually. The portfolio depends on different conditions of an investor such as risk strength, investment goals, and time.

The portfolio is periodically maintained because of changes in the original asset allocations, this is because of different returns and risks for the different asset classes. Minimizing the risk, and creating a balanced and diversified portfolio is the main objective of this portfolio.

Features Of Strategic Asset Allocation

- The strategy is defined for the long period rather than a short period

- It is rebalanced manually because of the performance of different asset classes

- Reduces the overall risk by spreading the investment in various asset classes

- This strategy is based on past/historical returns, future expected returns, and the correlation with the different assets classes

- The portfolio can be customized as per the investor’s risk strength, investment objectives, and time horizon.

Example Of Strategic Asset Allocation

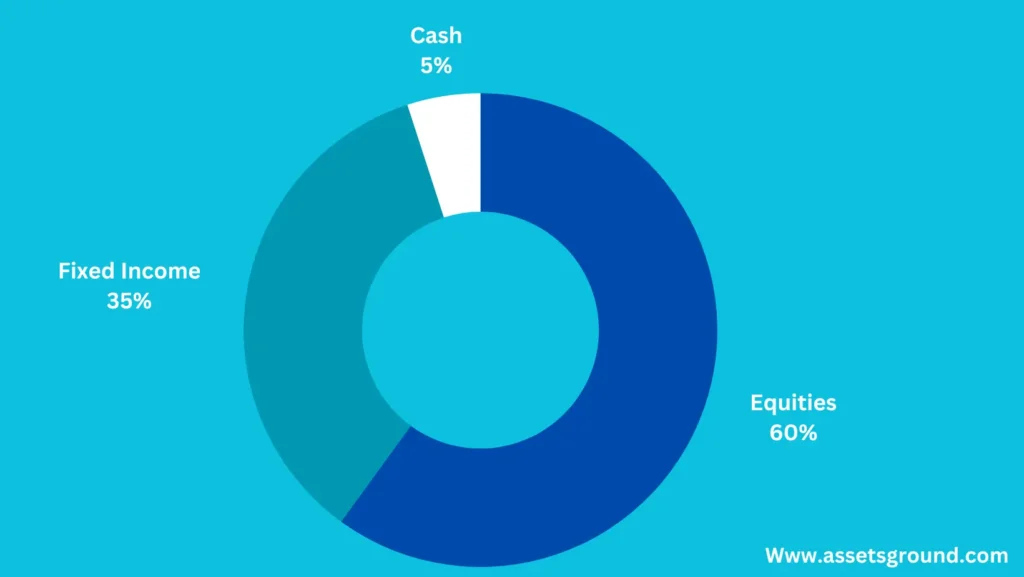

Albert focuses on long-term growth while focusing on managing risk and rebalancing the investment portfolio annually. He allocated the total amount of $100,000 to different assets as follows:

- Equities: 60%

- Fixed Income: 35%

- Cash & Cash Equivalents: 5%

After a year the equities component generates revenue of 10% while the fixed income is 5% and the cash & cash equivalents made only 2% of the return.

- Equities: $6000

- Fixed Income: $1750

- Cash & Cash Equivalents: $100

Now after a year, the total value of the investment portfolio is $107,850 which means the return after the year is 7.85%. Now the portfolio percentage is as follows:

- Equities: 61.2 %

- Fixed Income: 34.1%

- Cash & Cash Equivalents: 4.7%

The following is the table that will let you know, how to rebalance the amount:

| Asset Class | Allocation % | Targeted Amount | Current Amount | Adjustments (A-B) |

|---|---|---|---|---|

| Equities | 60% | $64,710 | $66,000 | -(1,290) |

| Fixed Income | 35% | $37,747.5 | $36,750 | 997.5 |

| Cash & Cash equivalents | 5% | $5,392.5 | $5,100 | 292.5 |

| Total | 100% | $107,850 | $107,850 | $0 |

$1,290 Equities need to be sold to balance the fixed income of $997.5 & cash & cash equivalents of $292.5.

Benefits Of Using Strategic Asset Allocation

There are dozens of benefits of using this strategy, the followings are the major benefits:

- This strategy helps investors to make a strong and diversified investment portfolio that helps them to get the best return and low risk in the long run

- The strategy helps investors to balance the risk and return by diversifying investment in different asset classes

- The strategy is very helpful in the long run because it helps investors to avoid to take wrong decisions during the short-term market fluctuations

- It can be customized as per the investor’s risk strength, investment goal, and time horizon

- It reduces the transactions cost as it is done for a long period and the trading & portfolio adjustments are also minimal

- It helps investors to get knowledge about different asset classes, their risks, returns, etc.