What Is Tactical Asset Allocation? Everything You Need To Know

What Is Tactical Asset Allocation

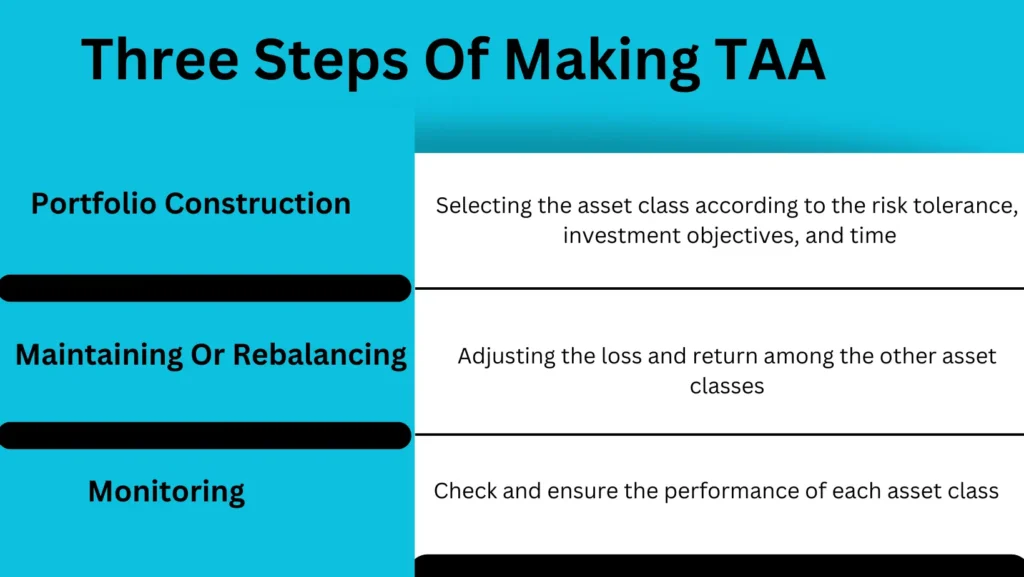

TAA is an active investment strategy that focuses on short-term adjustments according to the market and economic situations, or for other investment opportunities.

TAA is an active approach that looks at the performance of different asset classes and adjusts the investment profile according to the asset performance to keep the allocation fair and maintain to desired risk level.

TAA plays an essential role in buying, holding, and selling different assets according to their returns and performance and the situation of the market for that particular asset class.

The range of the TAA is between 5% to 10%, if the allocation exceeds 10% it may conflict with the long-term allocations (SAA).

Main Features Of Tactical Asset Allocation

TAA is designed to take advantage of the short or medium-market trends when a single asset class or all the classes perform well. The followings are the main feature of TAA.

- It involves making active decisions according to the market condition or investment opportunities

- It is a short-term investment normally of a few weeks or a couple of years

- It allows quick or flexible adjustments in the investment portfolio

- Control the risk by adjusting different asset classes as per the market condition.

Major Components Of TAA

| Asset Class | Stocks, Bonds, Commodities, Cash & Cash Equivalents are chosen based investor’s risk strength, investment goal, and time. |

| Time Horizon | Short-term investments that are normally held for a few weeks or a couple of years |

| Risk Management | Adjustments in asset classes to maintain the risk level |

What Are The Advantages Of TAA

- It enables investors to manage the investment portfolio as per the market condition

- The TAA offers flexibility in decision making

- TAA helps to enhance the return by moving low-performing asset classes to the high-performing asset class

- TAA offers different sources of return in a short time, etc.

What Are The Disadvantages Of TAA

- As it is a short-term allocation which means the buying and selling process will be repeated frequently that rises the transaction cost

- TAA will lead to loss if the decision of investment is proven wrong

- Decisions are made frequently that result in underperforming of assets

FAQs

Can we spread stocks in TAA?

Absolutely yes, one can spread his/her stock in different ways such as:

- 50% large-cap domestic stocks

- 30% medium-cap domestic stock

- 20% Foreign stock

How can one spread the bonds in tactical asset allocation?

The following is the way of spreading bonds in TAA:

- 40% Treasury bonds

- 40% Corporate bonds

- 20% Revenue bonds

How can one spread the cash and cash equivalents in TAA?

Here is the way of spreading cash and cash equivalents in TAA:

- 50% Cash

- 50% Money market fund

How does TAA work for an investor?

Investors allocate a percentage of the total investment amount in different asset classes according to his/her risk strength, investment goal, and time.