What Is A Contract Asset & How It Is Treated In Accounting

What Is A Contract Asset

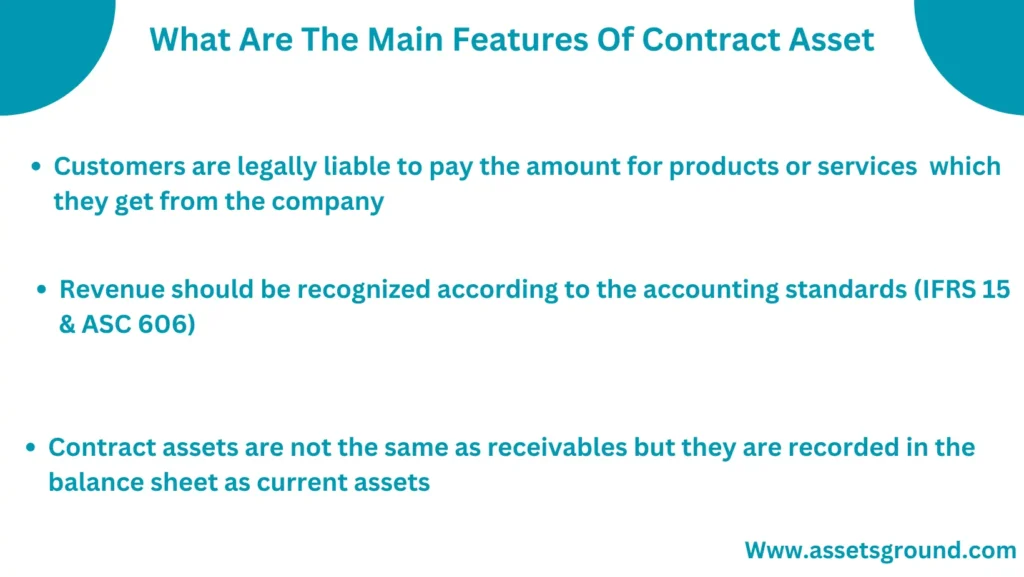

A contract asset is an accounting or financial term representing the right to get payment from the clients regarding offering services or products.

The contract assets are recognized according to the accounting standards such as IFRS 15 (International financial reporting standards) or ASC 606 (Accounting Standards Codification).

When a company delivers the goods to the customers or completes the services but the customer does not pay the company then the company records that outstanding value in its balance sheet as a contract asset.

A contract asset is a current asset because it is normally a short-term agreement and its payment can be received within a business cycle. The contract asset amount is recorded at the net realizable or expected value that can be received by the customers.

Why Contract Assets Are Important

Contract assets play a crucial role in overall all business operations. The followings are the major reasons why contract assets are important in a business.

- Contract assets help a business to improve its future cash flow

- Contract assets are recorded as current assets in the balance sheet and it improves the liquidity

- Managing an effective cash flow and maintaining working capital

- Contract assets help in bringing more investors by improving the liquidity ratios

FAQs

Is a contract asset a current asset?

Contract assets are considered short-term assets because the payment of contract assets is expected to receive within a business cycle.

Is a contract asset a liability?

Contract assets are an asset for the company that gives the services or products to customers, and it is a liability for customers if customers do not pay the company.

Is the contract asset the same as the account receivable?

Account receivable is not the same as a contract asset, a contract asset is a conditional right while the receivable is an unconditional right. The main difference between the trade receivable and contract asset is the condition.

What is a contract asset in simple words?

A contract asset is a right to get payment from the customers in respect of exchanging goods or services.

Is a contract asset considered cash?

A contract asset is treated as a current asset in a business because it is expected to receive within a business cycle. It helps a business to improve its cash flow in the next business cycle.

Is a contract asset a liquid asset?

Contract assets are expected to receive within a business cycle but they are not considered liquid assets because they are recognized according to certain conditions and agreements, and also these are not instantly convertible into cash.