What Is An Asset Impairment? Definition And Examples

Impairment means damaging, weakening, or declining the value of an economic resource of a company. The impairment concept in accounting plays a crucial role in making financial records true and fair.

What Is An Asset Impairment In Accounting

An impairment is a concept in financial accounting that helps a business to calculate its actual net worth. Impaired assets mean the value of an asset in the current market is less than in the statement of financial position which means the value of that asset has been declined or damaged.

If the asset is impaired and the current market value is less than the carrying value then a company must record the current market value of the asset rather than the carrying value of that asset.

Impairment of an asset concept plays a vital role in making financial statements true and fair and it helps a business to avoid the overstatement in the financial position of a company.

An asset can be impaired by different factors such as the customer’s demand, changes in legal factors, changes in the government, changes in the test of people, or damaging its condition.

Companies normally test impairment periodically because it helps a company to record the value of its assets fairly and avoid overstating the balance sheet.

Example Of An Impairment Asset

XYZ company bought a car for business operations on 31 January 2021 at $5,000. The company uses the straight-line depreciation method and the life of the car was 5 years when purchased. On 31 January December 2023, the current market value of the car is $1,000. The car is sold for $1,000.

What is the treatment of the above question in the accounting records?

When the car was purchased, it was recorded as:

- Debit: Car (An asset account) with $5,000

- Credit: cash/bank with $5,000

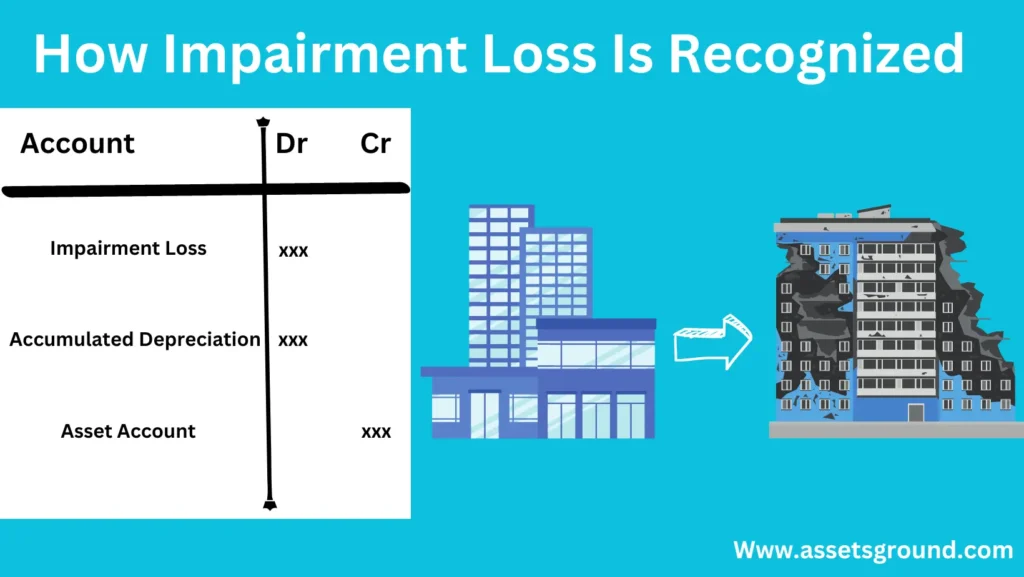

After 3 years when the asset is impaired, it will be recorded as the following.

- Debit: impairment loss or expense with $1,000

- Debit: accumulated depreciation with $3,000

- Debit: cash account with $1,000

- Credit: Car with $5,000

FAQs

Which assets are impaired most?

Fixed assets and intangible assets are impaired most because these are held for a long term, so they have always impairment risk.

How frequently a company should check for impaired assets?

A company normally checks the impairment periodically to check the balance sheet not show the overstated balance.

What is an example of asset impairment?

A company produces vehicles and in a natural disaster the machines in the company are damaged and the value of those machines declines suddenly below the carrying value.

What is the difference between depreciation and impairment?

Depreciation is the expected cost for a business because of assets used in operations while impairment is the incidental or sudden loss because of physical damages or natural disasters.