What Is Return On Assets And How It Is Calculated

What Is Return On Assets

ROA is a financial ratio that measures the profitability of a company by using its total assets in business operations. The ratio is very helpful in evaluating the performance and efficiency of a company in generating revenue using its financial resources.

The return on assets is shown in percentage, the higher the ROA the more profit a company generates using its resources.

The ROA ratio plays a vital role in attracting more clients, investors, and creditors because it allows them to compare the profitability and efficiency of the utilization of resources of different companies within the same industry or sectors.

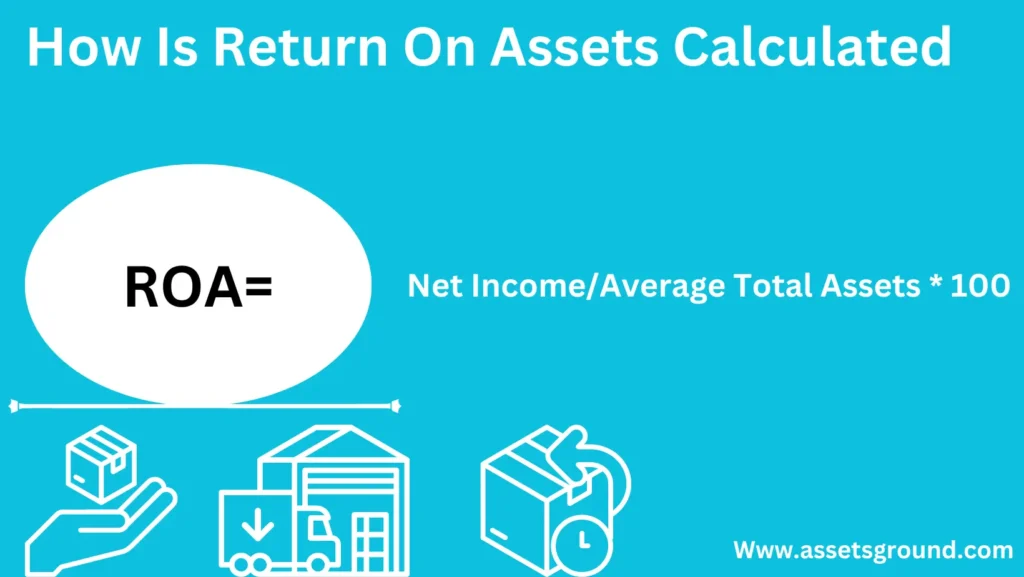

How Is Return On Assets Calculated

To find the ROI, it is essential to know the net income and average total assets of the company. Return on assets can be calculated using the following formula.

ROA= Net Income/Average Total Assets * 100

Net Income: net income is the total sales or revenue of a company for the current or a specific fiscal year minus all the operating and other expenses including tax.

Average Total Assets: the value of the total average assets can be calculated by adding the total assets at the start plus the total assets at the end and then dividing by 2.

Example Of Return On Assets

The XYZ company operates throughout the year and made the following value for its business.

- Total Income: $50,000

- Total Expenses: $5,000

- Assets at the beginning: $200,000

- Assets at the end of fiscal year: $300,000

Net Income: $50,000 minus $5,000 = $45,000

Average Total Assets: $200,000 plus $300,000/2 =$250,000

ROA: $45,000/$250,000*100= 18%

FAQs

What is considered a good ROA?

ROA will be different according to the business size or industry but generally more than 5% ROA is considered a good ROA while 20% or more is considered an extraordinary return.

How is ROA used by investors and creditors?

ROA is used by investors to identify whether they should invest in the company or not by insuring the stock utilization and opportunities while the creditors use this ratio to make sure whether they should give finance to a company or not.

Is a higher or lower ROA better?

A higher ROA shows the company’s efficiency and ability to generate revenue while a low ROA shows the inability or inefficiency to use the resources and generate the profit for the company.

Can ROA be negative?

ROA can be negative if a business makes losses or does not use the resources effectively.

What if a company’s ROA is less than 1?

If a company makes lower ROA then it means it is not using its resources effectively. Companies that make lower ROA should work on those areas where they can perform well.

What factors affect the ROA?

The sales volume and sales value and the operating or non-operating expense affect the return on assets.

How can I improve my ROA?

ROA is a financial indicator of a company that shows the ability and management of a company. If a company wants to improve its ROA, it must focus on planning, management, and execution of the available resources.