What Is The Book Value Of An Asset & How To Calculate It

What Is The Book Value Of An Asset

The book value or net book value is the net value of an asset as per the company’s accounting records. A company needs to record the book value of an asset or the entire company to know the actual worth of the company’s assets and the company itself.

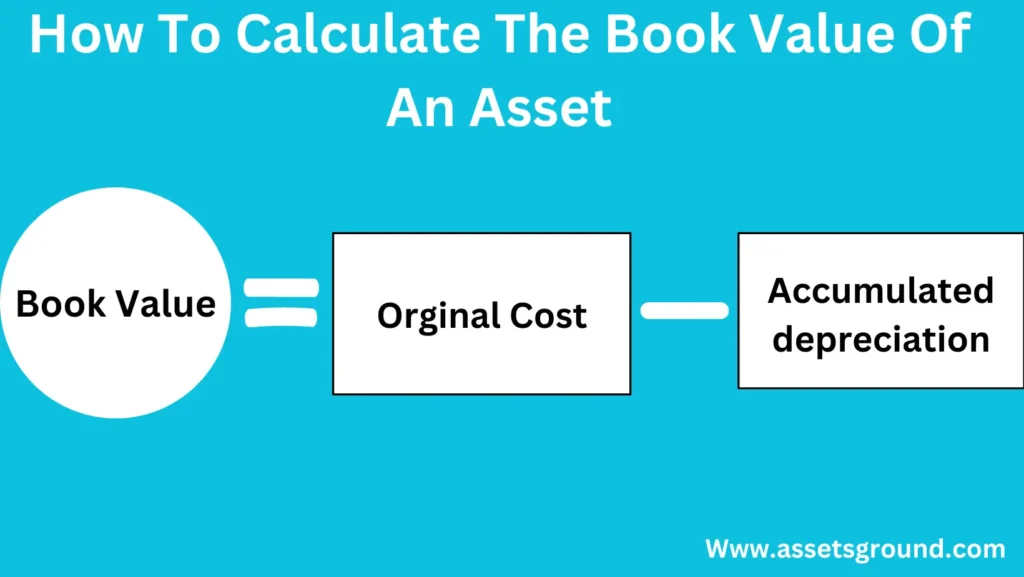

Two elements help to find the book value of an asset which are the original or historical cost and the accumulated depreciation.

Original or Historical Cost: this is the original or initial cost of an asset when it is purchased or made by the company.

Accumulated Depreciation: it is the total depreciation of an asset, the depreciation is a system of allocation of cost for an asset over its useful life. The depreciation method is used for tangible or hard assets while the amortization is used for intangible assets.

How To Calculate The Book Value Of An Asset

The book value of an asset is calculated for tax calculation because depreciation is recorded as an expense in the income statement which reduces the profit for the year which results in lower business tax. The book value of an asset can be calculated as:

Book Value= Orginal/Historical/Initial cost – Accumulated depreciation

Example: A company purchased a car worth $5,000 at the start of 2020. The company uses the straight-line depreciation method and the life of the car was 5 years when it is acquired. The company charges depreciation at the start of every year but the company did not charge depreciation expense when it was acquired.

What will be the book value of the car in December 2023?

Depreciation for 2020= 0 because no depreciation expense was charged when it was acquired

Depreciation for 2021= $5,000/5 =$,1000

Depreciation for 2022= $5,000/5 =$,1000

Depreciation for 2023= $5,000/5 =$,1000

So, accumulated depreciation is $3,000 ($1,000+$1,000+$1,000)

Book Value= Orginal Cost – Accumulated Depreciation

Book Value= $2,000 ($5,000 – $3,000)

FAQs

Is the book value and carrying value the same?

Yes, these both terms are used to record the present value of an asset after deducting all the depreciation expenses.

What is the difference between market value and book value?

Market value is the current price of an asset in the present market situation while the book value is the current value of an asset after the deduction of the accumulated depreciation from its original cost.

Why is book value important?

Book value is an important concept in accounting because it helps to know the actual worth of an asset or the whole company.