Which Assets Cannot Be Depreciated In Accounting & Why?

Depreciation is the method of allocation of cost to an asset over its useful life. Depreciation shows the wear and tear cost of an asset or the true value of an asset over its useful time.

Which Assets Cannot Be Depreciated?

The land is one of the most popular examples of NCA that is not depreciated because its life is not defined or has an infinite life.

Other assets such as trademarks or copyrights are also not depreciable even if they are amortized and become obsolete over time.

Those assets that are classified as held for sale are also not depreciated because those assets are expected to sale within a year or a business cycle.

Why Assets Are Depreciated

Assets are depreciated because of two factors which are the followings:

- Physical deterioration: when an asset loses its value because of its use

- Economic: when an asset loses its value because of economic conditions such as inflation and interest rate.

What Assets Are Not Depreciated

Following is the list of assets that are not depreciated or lose their value over time.

- Land

- Natural Resources

- Goodwill

- Trademark

- Copyright

- Patents

- Brand

- Inventory

- Artwork

- Share Investments

- Cash

- Cash equivalents

- Prepaid Expense

- Account Receivables

- Notes Receivables, etc.

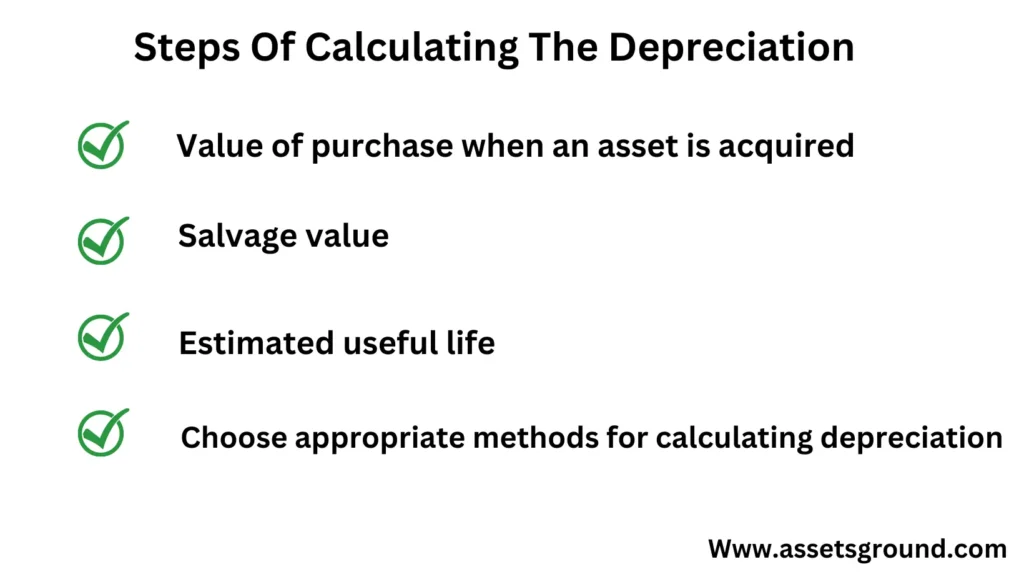

Steps Of Calculating The Depreciation

Calculating depreciation is essential as it shows the cash flow of a company and how an asset is performing. For calculating the depreciation one must follow these four sets to know the actual value of a depreciated asset.

- Value of purchase when an asset is acquired

- Salvage value

- Estimated useful life

- The appropriate methods for calculating depreciation such as the straight-line method, reducing balance method, Unit of production method, etc.

Why Depreciation Is Important

Depreciation is very important for a business to make financial statements true and fair as it plays a vital role in tax calculation.

Depreciation represents the wear and tear cost of an asset that helps a business to know the actual worth of the company. It helps a business to be financially stable in the market and helps in evaluating the performance of individual assets. If an asset value is not adjusted with time then the company has to pay double tax to the authorities.

FAQs

Which current assets cannot be depreciated?

Cash and account receivable are the most popular current assets that cannot be depreciated.

Which non-assets cannot be depreciated?

Land is a non-current asset that cannot be depreciated because it has an undefined life.

Can intangible assets be depreciated?

Intangible assets are not depreciated, they are amortized such as patents and trademarks.

Is accumulated depreciation an asset?

The accumulated depreciation is a contra asset and it reduces the value of an asset over its useful life. Accumulated depreciation is the total depreciation expense of an asset till the date when financial statements are prepared.